The Valuation of Network Effects in Cryptocurrencies and Blockchains

Network effects are paramount in cryptocurrencies and blockchains, just like in telephone and social networks: the higher the number of users, the more valuable the networks are. Blockchain networks follow Metcalfe’s law and their variants (Reed, Sarnoff, Beckstrom, Odlyzko, Gompertz, …): thus, the first metric to conquer is to reach the higher possible number of users.

Several recently published studies model the interrelationship between network effects and price:

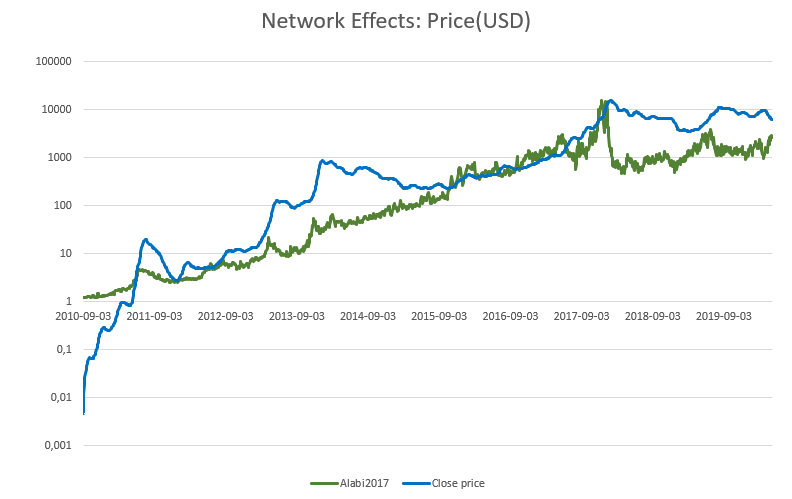

- “Digital blockchain networks appear to be following Metcalfe’s law”: BTC price in dollars based on the number of active daily users. A much more paper, “A 2020 perspective on “Digital blockchain networks appear to be following Metcalfe’s Law”” confirms that the correlation is still valid until January 2020, taking note of the end of the bubble of 2017.

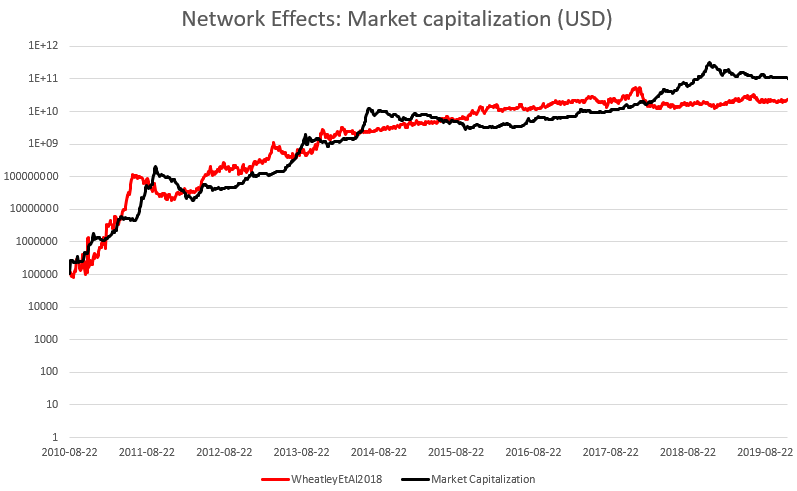

- “Are Bitcoin Bubbles Predictable? Combining a Generalized Metcalfe’s Law and the LPPLS Model”: derives the market capitalization of Bitcoin based on the number of daily users.

- “An Alternative Model of Metcalfe’s Law for Valuing Bitcoin”: another interesting model, but the independent variable of this model is a monthly time parameter, not the number of active users or unique wallets.

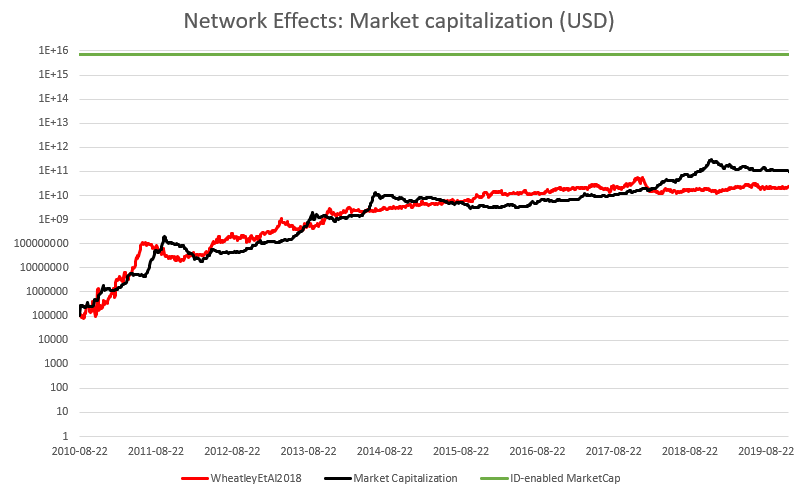

And according to the previous valuation models based on network effects, what would be the extrapolated market capitalization of an ID-enabled cryptocurrency?

Note that the previous chart only displays the extrapolated market capitalization for 1 billion users according to the Wheatley et al. model (constant green line, top of the chart): the extrapolation is four orders of magnitude higher than the current market capitalization of Bitcoin.

In our blockchain, you can send to and receive from more than the 1 billion users of Electronic Passports: our blockchain also includes National Identity Cards such as the ones from the European Union (almost 500MM).

DISCLAIMER: This is not investment advice. In addition to network effects, there are other relevant valuation KPIs and metrics: the only goal of this blog post is to highlight the importance of network effects.