Acquiring private companies is more complex than public ones because many parameters are private information. Secure computation is the perfect solution for these settings: an acquirer can offer a tentative deal to the target company without both ever revealing any kind of sensitive information.

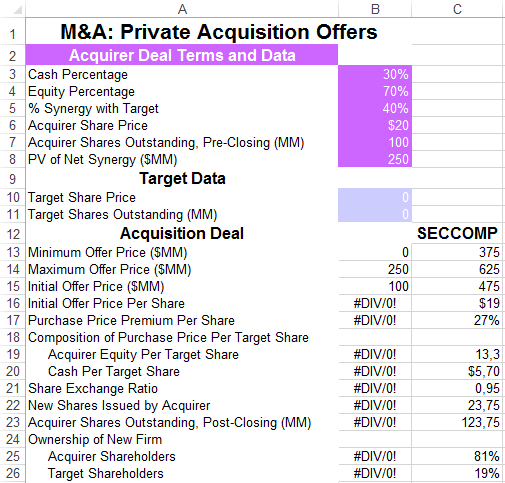

On one side, the acquirer specifies the terms of the deal and other private data: percentage of the deal in cash and in equity; percentage of expected synergies with the target company; present value of net synergies; and his own price per share and number of shares outstanding:

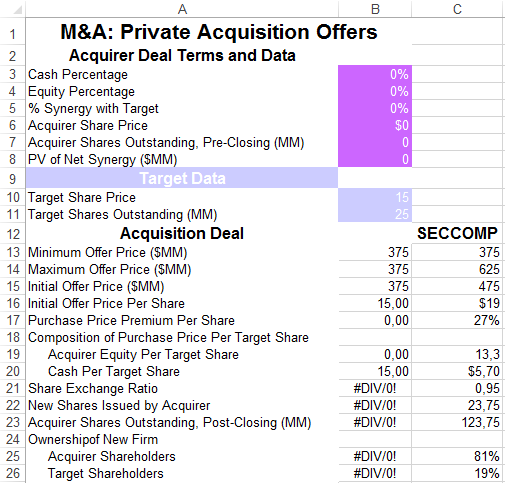

On the other side, the target company inputs the price per share and number of shares outstanding:

Both parties securely compute all the terms of the deal, from offered price to the new ownership of the firm.

DISCLAIMER

The preceding is just a simplified example for illustrative purposes. In the real world, you will have to provide parameters for your specific situation and use more complex formulas that fully capture the complexities of the deal.