Estimating the real synergies from private companies acquisitions, and not some out of the envelope projections, is a task fraught with perils: although acquisitions/merges may apparently make business sense, the deal should only go through when it’s supported by detailed accounting data. But such detailed data is rarely shared, since both companies usually operate on the same business field and they could be direct competitors.

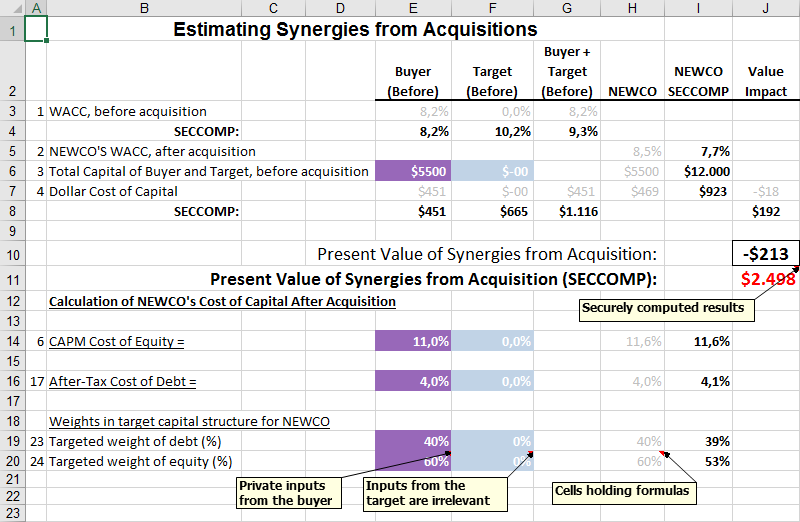

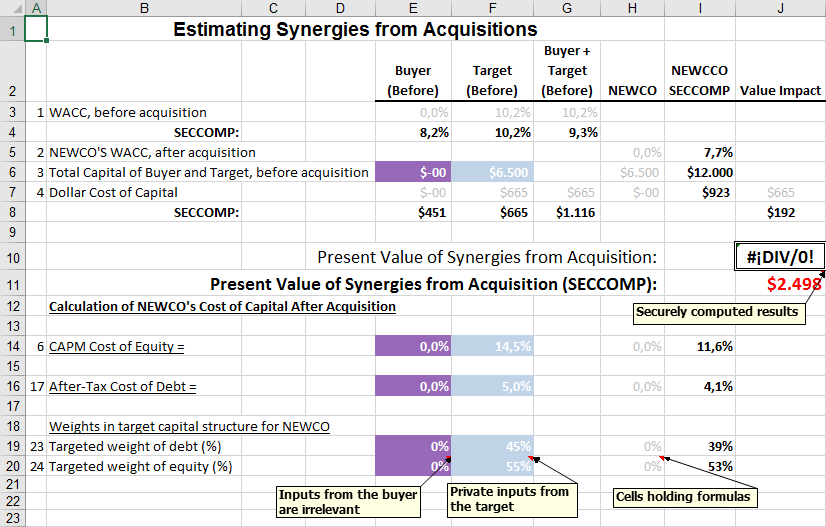

Fortunately, secure computation enables to precisely estimate the synergies and basic accounting facts of the resulting company NEWCO: both the buyer company and the target company specify some basic accounting facts (market value of the company; cost of equity and debt; and the ratio of equity/debt of the target company NEWCO) without the other party learning anything about them.

Then both parties proceed to calculate the equivalent accounting facts of the resulting company, to finally obtain the estimated value of the synergy.

Since the expected synergies are positive and reasonably large, the acquisition will go through after the due diligence phase that confirms that the inputed values were correct.

DISCLAIMER

The preceding is just a simplified example for illustrative purposes. In the real world, you will have to change the concrete parameters and use more complex formulas that fully capture the complexities of the deal.