Value at Risk is a measure of the risk of investments: it estimates the greatest expected loss at a given confidence level in a set time period, given normal market conditions. And now using secure computation, portfolios with private assets can be considered.

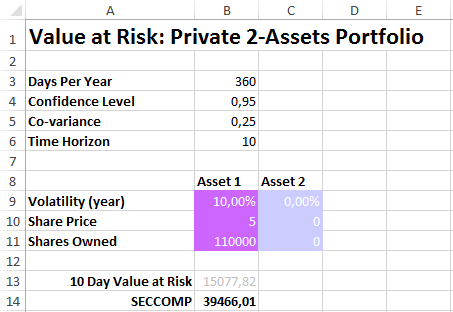

On one side, the first party specifies the yearly volatility, share price and number of shares owned:

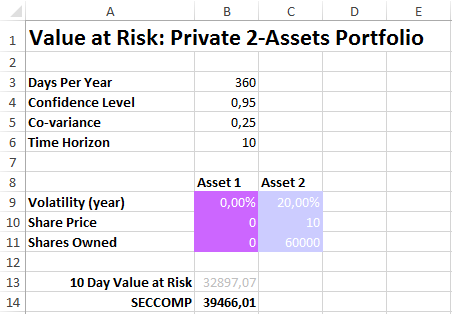

On the other side, the second party specifies the yearly volatility, share price and number of shares owned:

Both parties securely compute the Value at Risk of private assets for the given time horizon: with secure computation, financial risk exposures can be calculated and shared while preserving privacy.

DISCLAIMER

The preceding is just a simplified example for illustrative purposes. In the real world, you will have to provide parameters for your specific situation.