To hedge against exchange rate fluctuations, you may consider to purchase an option (the right, but not the obligation) to exchange one currency for another at a fixed price. The model of Garman-Kohlhagen was developed as an extension of the Black-Scholes model to price European-style foreign exchange options with two interest rates: and now enhanced with secure computation, it’s perfect to hedge private portfolios of volatile crypto-currencies.

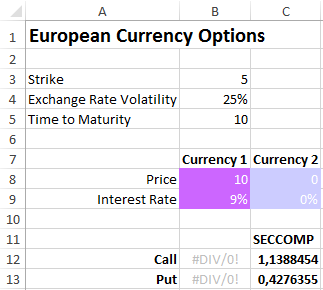

On one side, the first party specifies the current price of the currency and its interest rate:

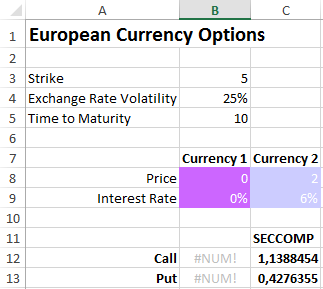

On the other side, the second party specifies the current price of the currency and its interest rate:

They securely compute the value of the call and put options: if at expiry the option is in the money, it should be exercised.

DISCLAIMER

The preceding is just a simplified example for illustrative purposes. In the real world, you will have to provide parameters for your specific situation.