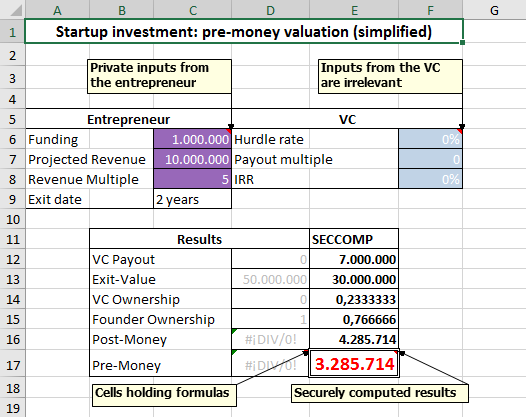

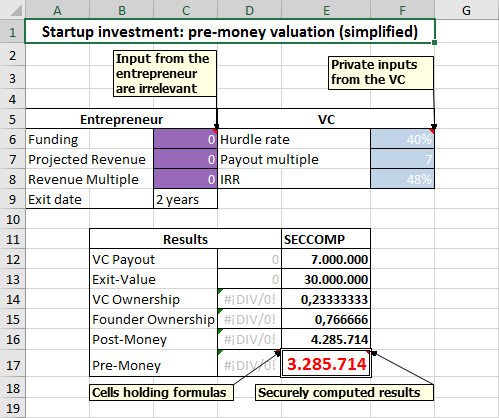

Entrepreneurs and Venture Capitalists negotiate complex deals where information from both sides is only partially disclosed: the entrepreneur may have not very reasonable funding requirements; and the VC may pretend to care more about other factors than the return for his own investment.

Secure computation is the perfect tool to better align the interests of both sides: the entrepreneur states his funding requirements, but without disclosing them to the VC.

And the VC states the returns sought. In the example both calculate, without disclosing to other party their own inputs some of the most contended terms of any seed/Series A investment: pre-money valuation and percentage ownership.

Although there may exist incentives to misrepresent facts to the other party, there are also counter-balancing strategies to prevent it: 1) both sides must have strong incentives to close the deal, and loose if the deal doesn’t go through; 2) the more complex the formulas used and the more inter-related their terms are, the more difficult is to devise a cheating strategy; 3) both sides should not have better alternatives to the negotiated agreement: the entrepreneur chooses his preferred VC, and either there are no alternative VCs or they are so subpar compared to the chosen VC, that the startup would be of lower value; the VC cannot find an alternative investment with the same risk/return profile and the startup is somehow unique compared to other investments (technological advantage, patents, brand recognition, …).

DISCLAIMER

The preceding is just a simplified example for illustrative purposes. In the real world, you will have to change the concrete parameters and use more complex formulas that fully capture the complexities of the deal.