Determining the exchange ratio of shares, the share of current shareholders of two merging companies, is very important: not only because it causes share price reactions of the merging companies, but more importantly because it also sets whether the held assets increase or decrease, impacting the value of the shareholders of the merging companies’ assets.

Fortunately, private companies can use a securified version of the Larson-Gonedes exchange rate ratio: a model based on Price-Earnings ratio, that also indicates the optimal boundaries of the exchange ratio, empirically verified in the U.S. during 1960-1969 (“An Empirical Test of the Larson-Gonedes Exchange Ratio Determination Model”) in the U.K. during 1984-1988 (“A UK Empirical Test of the Larson-Gonedes Exchange Ratio Model”).

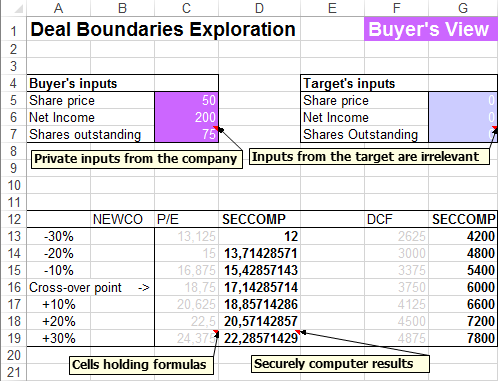

The buyer indicates the share price, net income and shares outstanding:

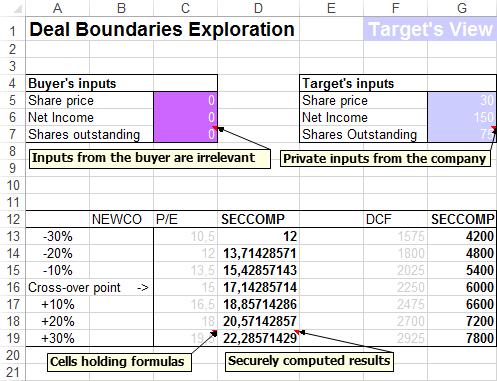

and the target indicates the equivalent parameters:

Jointly, they securely compute the exchange ratio and the DCF.

DISCLAIMER

The preceding is just a simplified example for illustrative purposes. In the real world, you will have to change the concrete parameters and use more complex formulas that fully capture the complexities of the deal.