Determining the financial soundness of a company or its likelihood of bankruptcy is of paramount importance. A classic technique is the Altman Z-score: this model is 80%-90% accurate in predicting bankruptcy one year before the event. Financial companies are usually excluded due to their off-balance sheet accounting practices: except that using secure computation, a Z-score can be calculated on opaque balance sheets.

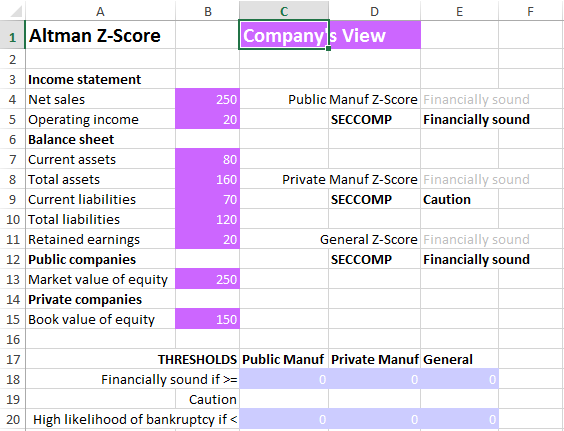

On one side, the company enters key data from the income statement and the balance sheet, and a valuation of the company (market value or book value):

On the other side, the auditor inputs the thresholds for the different kind of companies considered by the Altman Z-score (public manufacturer, private manufacturer and a general company):

Jointly, they securely compute the Altman Z-score to determine the default state of the company: financially sound, short-term cautions or a high likelihood of bankruptcy in the short term.

DISCLAIMER

The preceding is just a simplified example for illustrative purposes. In the real world, you will have to provide parameters for your specific situation.