On a daily basis, hundreds of private companies acquire other private companies: but the reality is that most of these deals are sub-optimal and many others do not even get closed, due to moral hazard and informational asymmetries.

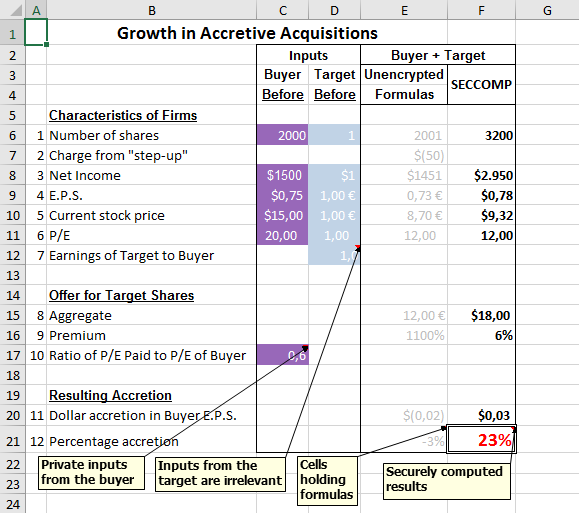

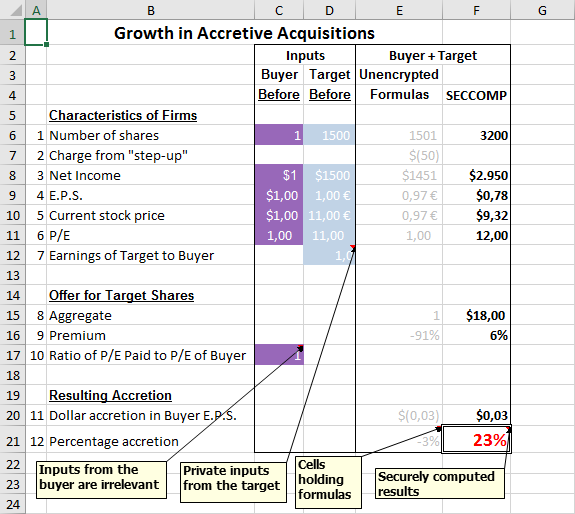

Secure computation solves these frequent problems in M&As: both companies specify their private accounting facts, without disclosing said facts to other party (numbers of shares; net income; Earnings Per Share; current stock price; Price Earning ratio).

Moreover, each side specifies the relative quality of the earnings and the Price Earning ratio to be paid, also privately used on the secure computation.

Jointly, they securely compute the accounting facts of the resulting company, the price to be paid for the target shares and what the percentage accretion would be. Since the deal is accretive, both parties agree to its terms: but before proceeding with the acquisition, both parties must do their due diligence and disclose to each other their accounting facts.

DISCLAIMER

The preceding is just a simplified example for illustrative purposes. In the real world, you will have to change the concrete parameters and use more complex formulas that fully capture the complexities of the deal.