Acquiring companies using significant amounts of debt to meet the cost of acquisition is a risky business: many times these acquisitions are vetoed by investment banks or the bonds issued are inadequately rated, and understandably due to the faced moral hazards and informational asymmetries.

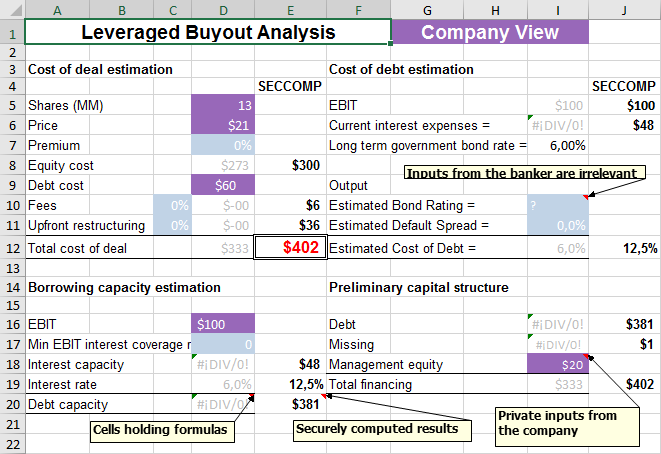

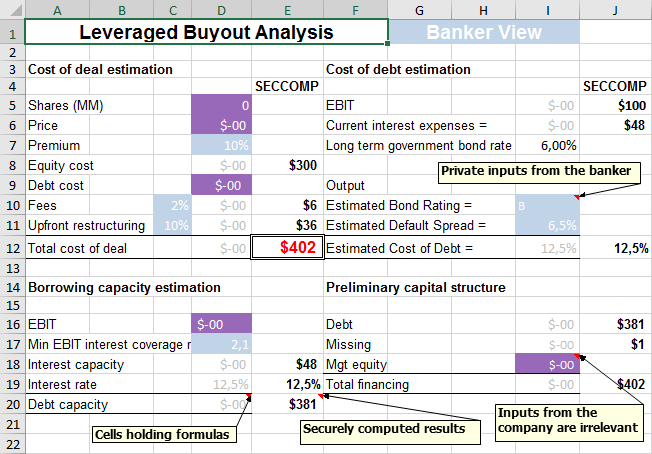

Fortunately, secure computation eases deal-making: on one side, the private company specifies its parameters (number of shares, price per share, EBIT, cost of debt, and the amount destined to management equity).

On the other side, the banker specifies its own requisites to finance the deal and other parameters estimated from industry averages (premium paid for the acquisition; percentage of fees earned by the bank; estimated cost of upfront restructuring of the acquired company; the minimum EBIT interest coverage rate; bond rating for the issued debt to finance the deal and its estimated default spread).

Finally, a due diligence phase is recommended to inspect the books before approving the deal.

DISCLAIMER

The preceding is just a simplified example for illustrative purposes. In the real world, you will have to change the concrete parameters and use more complex formulas that fully capture the complexities of the deal.