On the Coming Crackdown on Cryptocurrencies without Identity

In practice, using cryptocurrencies without identity means that the costs of identification are externalized to third-parties and, worse yet, repeated and incurred multiple times: KYC/AML to access online exchanges and/or for ICO participation (the cost of a check ranges from £10 to £100 for a manual identification and from £6 to £30 for an online identification). The need for anonymity is only a corner case even in cryptocurrencies specifically designed for anonymity: in Zcash, fully shielded transactions represent 1.5% of all transactions and 5% of all value.

Many countries are already banning cryptocurrency transactions without identity:

- China (Proposed Regulations for Identity on Blockchains)

- Russia (About Digital Financial Assets)

- South Korea (Ban of Anonymous Cryptocurrency Trading)

- Japan (Japan’s Financial Regulator Is Pushing Crypto Exchanges To Drop ‘Altcoins’ Favored By Criminals)

- France (Ban of Anonymous Cryptocurrency)

- Texas (Proposed Bill Requiring Identity Verification)

- the “travel rule” of the FAFT regulations

- the strict Know-Your-Customer (KYC) requirements of the European Union’s AMLD5 directive

This trend will only continue in the future as cryptocurrency usage keeps increasing.

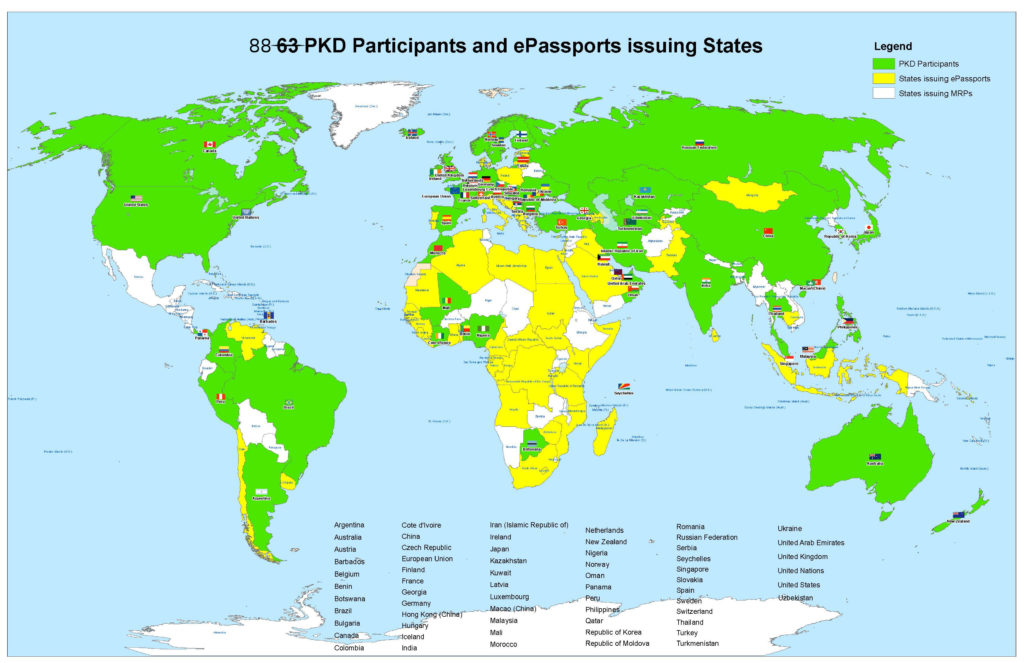

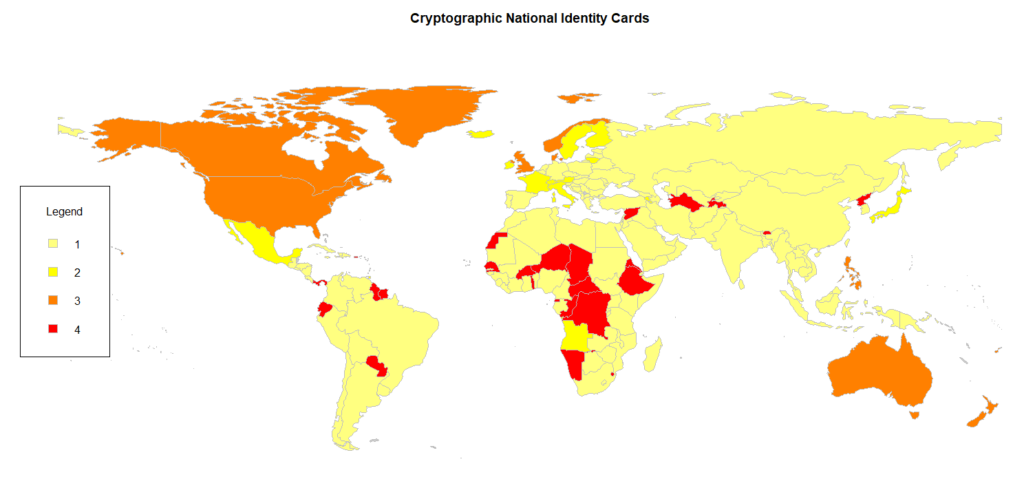

We offer the first cryptocurrency where only real-world cryptographic identities can be used (e.g., National Identity Cards and/or ePassports) lowering the costs of identification for all parties involved and increasing the acceptance by merchants in real-world scenarios.

Holding pro-law cryptocurrency is the only safe bet.